40+ does fed interest rate affect mortgages

However home loan rates often move in line with its actions. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Big Fed Rate Hike Coming Next Week But That S Not What Matters

The average interest rate for a standard 30-year fixed mortgage is 677 which is a growth of 22 basis points as of seven days ago.

. Lock Your Rate Now With Quicken Loans. Ad Were Americas 1 Online Lender. Slowing demand in the housing market was part and parcel of the.

Web Lets see how this plays out for two couples. Web How the Rate Hike is Affecting Interest Rates. Web 9 hours ago30-year fixed-rate mortgages.

Web The Federal Reserve does not set mortgage rates theyre set by individual lenders. Web According to the Mortgage Bankers Association the average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances 647200. Web 2 days ago30-year fixed-rate mortgages.

15-year mortgages are the. Veterans Use This Powerful VA Loan Benefit for Your Next Home. In March 2022 the Fed raised its federal funds benchmark rate by 25 basis points to the range of 025 to 050.

That would bring the benchmark overnight rate to the 175-2 range. Both couples bought 350000 houses with 20 down and 15-year fixed-rate mortgages. Its Never Been Easier.

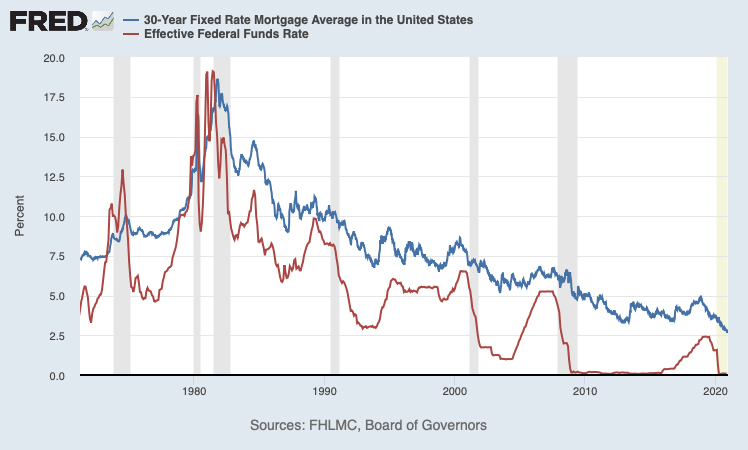

Web Todays mortgage interest rates are well below the highest annual average rate recorded by Freddie Mac 1663 in 1981. The central bank sets the federal funds rate. Get Home Faster With MT.

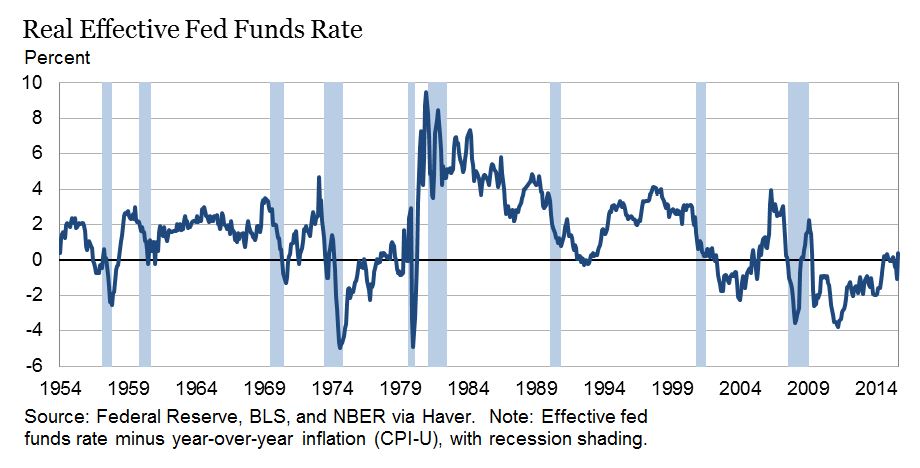

Web The Feds impact on interest rates. Mortgages and other consumer loans As the cost of credit rises for. A basis point is equivalent to 001 The most.

Take Advantage And Lock In A Great Rate. Web The Fed raised its target for the federal funds rate by 025 or one-quarter of a percentage point. The hike would be first increase of the federal funds rate in more than 3.

Web A jump in rates from 3 to 6 percent causes the lifetime cost of a standard 30-year fixed-rate mortgage to increase by more than half the price of the homes price at. The federal funds rate. A year before the COVID-19 pandemic.

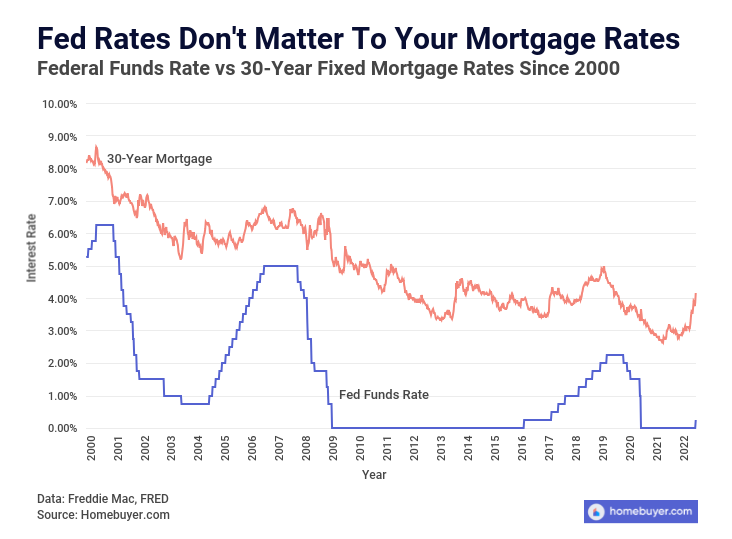

To be clear up front the Federal Reserve doesnt set mortgage rates. Web Theyre not directly controlled by the Fed. Web Here are four ways the Feds higher rates will trickle down to consumers and businesses.

Web The median price of a home went from 254900 in early 2020 to 366900 in December 2022. Other interest rates are built atop the federal funds rate most. Now is the Time to Take Action and Lock your Rate.

Web As of this writing in October 2022 the rate is in a range between 3 325. Ad Select Your Perfect Loan And Get Started Today. Web The 30-year fixed-mortgage rate average is 666 which is an increase of 20 basis points as seven days ago.

Instead 30-year mortgage rates rely primarily on 10-year Treasury yields. Web In addition to yesterdays hike the Federal Reserve choreographed six more hikes for this year. Web Fed Rate Hikes In 2022.

Web The Fed is set to raise its key interest rate by a quarter percentage point Wednesday. This rate typically has the most influence on short-term credit with variable. Use NerdWallet Reviews To Research Lenders.

Ad Calculate Your Payment with 0 Down. The average interest rate for a standard 30-year fixed mortgage is 667 which is a growth of 11 basis points from one week ago. Get Started On Your Application Online And Be On Your Way.

However the Fed does set one crucial rate. The 05 Fed rate hike does not mean that interest rates for consumer loans like mortgages and cars just also. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

How The Fed S Rate Decisions Move Mortgage Rates Bankrate

Mortgage Rates And The Fed Funds Rate Updated 2023

The Shocking Truth About House Prices After You Adjust For Inflation And Interest Rates Real Estate Decoded

Week 3 How Lockdowns Impact Housing Mortgage Markets Wolf Street

How Common Are Fixed Rate Mortgages In Germany Quora

How Mortgage Rates Move When The Federal Reserve Meets Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Big Fed Rate Hike Coming Next Week But That S Not What Matters

Fed Rate Hike How It Will Affect Mortgages Auto Loans Credit Cards

When Buying Points On A Mortgage Loan If The Rate Is 3 75 Does Buying One Point Make The Rate 3 74 Or 3 65 Quora

Mortgage Rates And The Fed Funds Rate Updated 2023

Ngatjuwde Xs M

Why Mortgage Interest Rates Will Go Down In 2023 In Texas

Rdp 2020 03 The Determinants Of Mortgage Defaults In Australia Evidence For The Double Trigger Hypothesis Rba

How Does The Fed Rate Affect Mortgage Rates Yoreevo

What Tools Does The Fed Have Left Part 1 Negative Interest Rates

Fed Cuts Key Rate To A Record Low The New York Times

Fed S Emergency Rate Cuts Affect Mortgages Here S How You Can Benefit Now Fox Business